You’re at PTC right now. You just met a stack of great people. The emails start piling up the second you land. Meanwhile, you still have a business to run: quotes, facility tours, MSAs, and renewals. An AI sales agent for data centers solves this immediately. It keeps every conversation moving while you’re still traveling—and extends into operations and finance workflows so deals don’t stall after the handshake.

Hunter Newby

Partner, Percepture & Pyrabuilds.aiKEY TAKEAWAYS

Time: Cut RFP response time from 2 weeks to <30 minutes (drafts ready for review instantly).

Capacity: Handle 5x more leads without hiring a single new BDR.

Proof: +3,000% AI visibility | 4x in leads in 90 days (enterprise data center provider since 1988).

Case Study

Why AI Agents for Data Centers Win Deals Between Conferences

Data center deals move fast, and the details matter. You meet a VP of Infrastructure at PTC’26 in Honolulu. They need 5 MW in Northern Virginia by Q3. You talk through requirements, align on next steps, and agree to follow up with a pricing pack, a tour, and an MSA draft.

Then real life kicks in—travel, internal handoffs, approvals, and the rest of the business. An AI sales agent for data centers keeps the momentum going in the background: it sends a clean recap, routes the right tasks to pricing and legal, schedules the tour, and tracks what’s still needed—so the deal stays warm and your team stays focused.

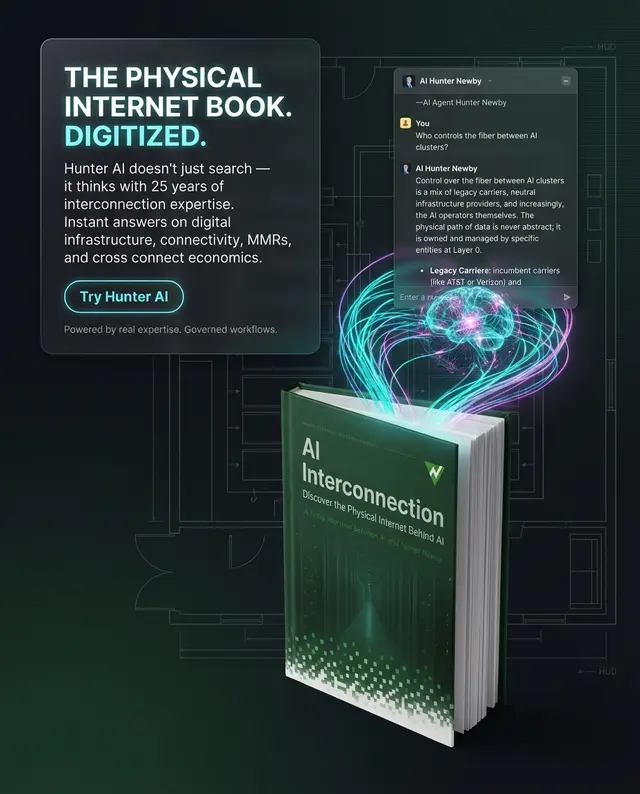

Data Center Sales Cycle: Where Deals Stall

- Day 0–3: Post-conference follow-up delay (prospect expects response within 24 hours; manual recaps take 3 days)

- Day 7–14: Tour scheduling limbo (aligning the VP, CTO, and Site Ops calendars for a walk-through)

- Day 21–30: Security questionnaire bottleneck (150+ questions, manual copy-paste from old Excel files)

- Day 30–45: Pricing pack delay (finance backlog, validating rack density & power availability)

- Day 60–90+: MSA/SLA negotiation stall (legal review, redlines, and “version control”)

According to Salesforce research, 83% of sales teams using AI saw revenue growth, compared to just 66% without AI. In the data center industry—where deals average $500K to $50M+ and sales cycles stretch 6–18 months—every day of delay costs real money.

What Is an AI Agent (In Data Center Terms)?

An AI agent isn’t a chatbot or a copilot that suggests what you should do. AI agents for data centers are autonomous software workers that complete tasks end-to-end, using the same tools your team uses—CRM, email, LinkedIn, Slack, phone, shared drives, pricing calculators, contract templates.

Think of it this way: A chatbot answers questions. A copilot drafts an email for you to review. An agent sends the email, logs it in your CRM, schedules the follow-up, and escalates to a human only if the prospect replies with a question outside its scope.

Here’s the difference in a data center context:

AI Agents vs Traditional Automation

| Capability | Traditional Automation | AI Agents for Data Centers |

| Post-conference follow-up | Email template (manual send) | Personalized email with meeting recap, next steps, calendar link—sent automatically within 2 hours |

| Security questionnaire | Manual copy/paste from previous answers | Agent pulls answers from knowledge base, adapts to new questions, flags unknowns for human review |

| Pricing pack generation | Finance team builds Excel file (3–5 days) | Agent generates pricing options based on kW/rack density, cross-connect needs, SLA tier—delivered in 24 hours |

| MSA/SLA workflow | Legal team reviews manually (2–4 weeks) | Agent highlights standard vs. custom clauses, suggests redlines, tracks version history |

| Tour scheduling | Back-and-forth emails (avg. 7 touches) | Agent checks site availability, sends calendar invite, coordinates NOC access, confirms 24 hours prior |

The key insight: AI agents for data centers work with your existing tools and workflows. You don’t rip out your CRM or retrain your team. The agent integrates via API, learns your processes, and starts handling the 70% of tasks that don’t require human judgment.

AI Sales Agents for Data Centers

This is where AI agents for data centers deliver immediate ROI. Sales teams in the colo, hyperscale, and interconnection space face unique challenges that generic sales AI can’t solve. You’re not selling SaaS subscriptions—you’re selling multi-year contracts for physical infrastructure with complex technical, legal, and financial requirements.

Here’s what a data center sales agent actually does, using Percepture’s AI Sales Agents as the reference architecture:

10 Sales Workflows an Agent Can Run:

- Meeting recap → next steps: After every prospect call, the agent drafts a summary email with action items, timeline, and calendar links—sent within 2 hours while the conversation is fresh

- Pricing pack for kW/rack density options: Prospect needs 10 racks at 20 kW each in Ashburn? Agent generates pricing tiers (standard/premium SLA), cross-connect options, and power availability windows

- MSA checklist + SLA highlights: Agent compares your standard MSA against prospect’s requirements, flags deviations, suggests negotiation points

- Security questionnaire answer pack: Prospect sends 150-question security assessment? Agent pulls answers from your SOC 2 report, compliance docs, and previous questionnaires—human reviews only the 12 custom questions

- “Why us” comparison vs. top competitors: Agent builds competitive battlecards based on your differentiators (latency, carrier ecosystem, uptime SLA, pricing)

- Intro emails to ecosystem partners: Prospect needs fiber to your facility? Agent drafts warm intros to your carrier partners (Zayo, Lumen, Crown Castle) with context

- Tour scheduling automation: Agent coordinates with NOC, checks site availability, sends calendar invites, confirms access 24 hours prior

- Pipeline hygiene: Agent flags stale deals (no activity in 14+ days), suggests re-engagement tactics, updates CRM automatically

- Contract renewal reminders: Agent monitors contract expiration dates, triggers renewal conversations 90 days prior, drafts renewal proposals

- RFP response coordination: Agent extracts requirements from RFP documents, assigns sections to team members, tracks completion, compiles final submission

The result? Verizon reported sales up nearly 40% after deploying an AI assistant. In the data center world, where average deal size is $2M–$10M for colo and $50M+ for hyperscale builds, a 40% lift translates to tens of millions in incremental revenue.

📅 PTC Follow-Up Workflow: Day 0 to Day 14

(1) Day 0 (Conference Day):

- Sales rep meets prospect, exchanges business card, promises follow-up

- Rep logs meeting notes in CRM (or scribbles on back of badge)

(2) Day 0 + 2 hours (Agent Auto-Trigger):

- Agent pulls CRM notes, drafts personalized follow-up email

- Email includes: meeting recap, next steps, calendar link for tour, link to pricing calculator

- Agent sends email, logs activity, sets reminder for Day 3 if no response

(3) Day 3 (If No Response):

- Agent sends gentle nudge: “Following up on our PTC conversation—still interested in 5 MW in Ashburn?”

(4) Day 7 (Prospect Replies with Security Questionnaire):

- Agent receives 150-question PDF, extracts questions, matches 138 answers from knowledge base

- The agent flags 12 custom questions for human review, drafts responses for the rest

- Human reviews, approves, agent sends completed questionnaire—total time: 90 minutes (vs. 8 hours manual)

(5) Day 10 (Prospect Requests Pricing):

- Agent generates pricing pack: 10 racks, 20 kW/rack, premium SLA, 3-year term

- Includes: power availability windows, cross-connect options, carrier ecosystem map

- Delivered in 24 hours (vs. 5 days waiting for finance team)

(6) Day 14 (Tour Scheduled):

- Agent coordinates with NOC, sends calendar invite, confirms site access, sends reminder 24 hours prior

This is the workflow that separates winners from losers in the data center sales game. AI agents for data centers don’t just speed up follow-up—they eliminate the human error, calendar conflicts, and “I forgot” moments that kill deals.

Pricing for Data Center AI Agents

AI Agents for Data Center Executives (Visibility + Forecasting)

IAs a VP of Sales or CRO, you don’t need another dashboard—you need a decision engine. While traditional teams rely on “reactive reporting” (analyzing why they missed), AI-enabled executives use “proactive prescription” (knowing how to hit).

The difference is measurable. Industry data shows that leads sourced from AI/LLMs convert at 5x–9x the rate of traditional traffic (approx. 16% vs 1.8%). Why? Because an AI lead has already “interviewed” you before they ever click your link.

- The “Exec Narrative” Pack Instead of a spreadsheet dump, your AI agent delivers a weekly strategic briefing:

- Competitive Intel: “Prospects mentioned Equinix 12 times and Digital Realty 8 times this week. Trend: Pricing objections are up 15%. Counter-measure: Auto-send our ‘TCO vs. Competitors’ one-pager to all active negotiations.”

- Pipeline Velocity: “23 active opportunities ($47M). 8 deals stalled at the ‘Security Questionnaire’ stage (Avg delay: 12 days). Recommendation: Auto-draft responses for these 8 to recover ~$15M in pipeline velocity.”

- Forecast Confidence: “Q1 Forecast: $12M. Confidence Score: 78% (Up from 65% last week). AI analysis shows 95% accuracy when key stakeholders are multi-threaded.”

- Lead Quality Signal: “Inbound volume is flat, but intent is up. 16 out of 100 AI-sourced visitors are booking meetings (vs. 2 out of 100 from organic search). Action: Shift Q2 budget to capture more high-intent AI traffic.”

This is the difference between reactive management (“Why did we miss our number?”) and proactive leadership (“We’re going to miss our number unless we solve the legal bottleneck—here’s the plan”).

These ai agents can give you answers. Gartner predicts that up to 40% of enterprise apps will feature task-specific AI agents by 2026. The data center operators and others who adopt early will have 12–18 months of competitive advantage before this becomes more common.

AI Agents for Data Center Operations (Ticket Triage, RCA, Comms)

Sales isn’t the only place where AI agents for data centers deliver value. Operations teams—NOC engineers, facility managers, customer success—face the same problem: too many repetitive tasks, not enough hours.

Here’s where operational agents shine, using Pyra’s telecom and data center operations agents as the model:

Operations Workflows:

• Ticket triage: Customer reports “slow network performance.” Agent checks: power draw (normal), cooling (normal), cross-connect utilization (85% on Port 12). Agent escalates to network team with context: “Likely congestion on customer’s 10G cross-connect—recommend upgrade to 100G.”

• Root cause analysis (RCA): Power event at 2:47 AM. Agent correlates: UPS switchover log, generator startup time, customer impact (3 racks offline for 47 seconds). Agent drafts RCA report, sends to affected customers within 4 hours (vs. 48 hours manual).

• Customer comms: Planned maintenance window Saturday 2–6 AM. Agent sends notifications 7 days prior, 48 hours prior, 24 hours prior. Tracks acknowledgments, escalates non-responders to account manager.

• Capacity planning: Agent monitors power utilization across all facilities. Flags: “Dallas-1 at 78% power capacity. Current growth rate: 3% per month. Recommend procurement of additional UPS modules by Q3 to avoid capacity constraints.”

Image: Uptime Institute’s Global Data Center Survey (2024) asked operators about benefits of using AI in operations. The top perceived benefits included: increased facility efficiency (58%), lower risk of human error (55%), and increased staff productivity (45%), along with lower risk of equipment failure/outages (42%) and reduced maintenance/service costs (37%). The operational upside for a data center is massive.

AI Agents for Data Center Finance (Close Support + Pricing Packs)

Finance teams in data center companies are drowning. Every deal requires custom pricing (kW/rack, cross-connect fees, SLA tiers, contract term discounts). Every contract requires revenue recognition analysis (CapEx vs. OpEx, prepayment terms, usage overages).

AI agents for data centers handle the 80% of pricing requests that follow standard logic:

Finance Workflows:

- Standard pricing pack: 10 racks, 15 kW/rack, 3-year term, standard SLA → Agent generates pricing in 10 minutes

- Custom pricing pack: 50 racks, 25 kW/rack, 5-year term, premium SLA, 20 cross-connects, dedicated fiber → Agent flags for CFO review, provides comparable deal benchmarks

- Revenue recognition: Agent analyzes contract terms, flags: “Customer prepaid 12 months—recognize revenue monthly per ASC 606. Usage overages billed quarterly—recognize upon invoice.”

- Deal approval workflow: Sales rep submits deal for approval. Agent checks: margin > 35% (✓), contract term > 24 months (✓), customer credit score > 650 (✗ — escalate to CFO).

The result? Finance teams spend less time building spreadsheets and more time on strategic analysis (M&A modeling, capacity planning, investor relations).

The Workflow That Actually Works (Governance First)

Here’s the uncomfortable truth: Most AI projects fail. Gartner and Reuters report that 40%+ of agentic AI projects may be scrapped due to cost overruns, unclear outcomes, or lack of governance.

The data center operators who succeed with AI agents for data centers follow a simple rule: Prove control, then scale.

✅ Governance Checklist (Before You Deploy)

- Approval gates: Agent can draft emails, but human must approve before sending (at least initially)

- Audit logs: Every agent action is logged—who, what, when, why

- Escalation rules: Agent knows when to hand off to human (e.g., prospect asks about custom SLA terms outside standard range)

- RBAC (role-based access control): Sales agents can’t access finance data; ops agents can’t modify customer contracts

- SOC 2 Type II compliance: Agent infrastructure meets same security standards as your CRM and billing systems

- Human-in-the-loop for high-risk tasks: Pricing above $5M, contract terms > 5 years, custom SLA commitments—always require human review

This is exactly how Pyra builds AI agents—governance first, automation second. The platform includes approval gates, audit logs, and RBAC out of the box, plus SOC 2 Type II compliance for enterprises that can’t afford security risks.

Start small. Pick one workflow (ex. post-conference follow-up). Deploy the agent in “draft mode” (it writes emails, you approve). Measure results (response rate, time saved). Once you trust it, move to “auto mode” (agent sends emails, you review logs). Then expand to the next workflow. We will be with you every step of the way in our 20 -60 – 20 model, where every agent is assigned an AI operator.

Industry Benchmarks (Not Our Telecom Marketing Case Study)

Let’s separate industry data from vendor claims. Here’s what third-party research shows about AI agents in sales and operations:

- Verizon: Reported sales up nearly 40% after deploying an AI assistant (Reuters, April 2025)

- Salesforce: 83% of sales teams with AI saw revenue growth, compared to 66% without AI (2024 Sales AI Statistics)

- Gartner: Predicts up to 40% of enterprise apps will feature task-specific AI agents by 2026, up from less than 5% in 2025

- JLL: Data center sector projected to increase by 97 GW between 2025 and 2030—effectively doubling global capacity

These aren’t vendor case studies. They’re industry-wide trends. The data center operators who adopt AI agents for data centers early will capture disproportionate market share as the industry doubles in size over the next five years.

Our Results (Data Center Service Provider)

Client: 35+ year digital infrastructure firm (colo + interconnection)

Challenge: Despite relationships, projects, fortune 500 clients and nearly 100% customer retention, ChatGPT, Google and some of the newer people in the industry were unfamiliar with them.

Solution: Deployed Pyra AI agents for Generative Engine Optimization Services + Percepture AI Sales Agents for lead notification

Timeline: 90 day results

Results:

- +3,000% AI visibility: Executive team went from zero AI-driven insights to weekly narrative packs with pipeline health, competitive intel, and forecast accuracy

- 40% reduction in sales cycle length: Average time from first contact to signed MSA dropped from 120 days to 72 days

- Zero manual follow-up errors: Every prospect received follow-up within 24 hours (vs. 60% manual follow-up rate pre-agent)

- Security questionnaire time cut by 85%: Average completion time dropped from 8 hours to 90 minutes

Key Insight: The client didn’t replace their sales team. They gave their team superpowers. Sales reps now spend 70% of their time on high-value activities (customer calls, site tours, relationship building) instead of administrative busywork.

FAQ people have on AI Agents

What’s the difference between AI agents and chatbots for data centers?

Can AI agents for data centers handle custom pricing requests?

How do AI agents for data centers integrate with existing CRM systems?

What happens if an AI agent makes a mistake in a customer email?

How long does it take to deploy AI agents for data centers?

Do AI agents for data centers replace sales reps or NOC engineers?

What’s the ROI of AI agents for data centers?

Can AI agents for data centers handle multi-site operations?

Are AI agents for data centers secure enough for enterprise use?

What’s the biggest risk of deploying AI agents for data centers?

Next Step: See an AI Sales Agent Live

If you made it this far, you’re serious about AI agents for data centers. Here’s what to do next:

- Book a demo: See Percepture AI Sales Agents in action—live walkthrough of post-conference follow-up, security questionnaire automation, and executive visibility

- Explore Pyra’s platform: Learn how Pyra builds AI agents with governance, audit logs, and SOC 2 Type II compliance

- Read Hunter Newby’s work: Dive into AI Interconnection for the strategic context behind data center site selection, carrier ecosystems, and interconnection economics

The data center industry is doubling in size over the next five years (97 GW of new capacity, per JLL). The operators who win will be the ones who solve the follow-up problem, the security questionnaire bottleneck, and the pipeline visibility gap.

AI agents for data centers aren’t the future. They’re the present. The question is: Will you adopt early and capture market share, or wait until your competitors have a 12-month head start?