Quick Answer

ARPU (Average Revenue Per User) is the average monthly revenue a telecom provider or ISP earns per subscriber over a set period. Calculated as Total Service Revenue ÷ Average Active Subscribers, it serves as the primary health check for an operator’s pricing power and product-market fit.

When ARPU Matters Most

- Mobile operators tracking subscriber value across prepaid and postpaid plans

- FTTH/ISP providers measuring broadband service revenue and upsell effectiveness

- Subscription services evaluating pricing strategy and customer lifetime value

Want an executive-led telecom marketing and pr agency for your business?

Quick Summary

What Is ARPU? The 2026 Executive Guide to Telecom Revenue Strategy

This is the definitive resource for telecom operators, ISPs, and FTTH providers to master Average Revenue Per User (ARPU). In this guide, we move beyond simple definitions to provide a strategic framework for:

- Optimizing Tiered Pricing Models: Aligning service value with subscriber willingness-to-pay.

- Reducing Cost-Per-Bit: Protecting margins when ARPU remains flat.

- Securing Infrastructure Capital: How ARPU Projections Drive Data Center Financing Structures.

What Does ARPU Mean in Telecom?

ARPU stands for Average Revenue Per User, and in telecom, it’s one of the most closely watched metrics on every operator’s board pack. But here’s what most generic finance definitions miss: It is a retail metric tied directly to subscriber revenue, not network costs or infrastructure investment.

Think of it as the “top line per customer” number. It tells you how much money each subscriber brings in the door each month, but it doesn’t tell you whether that revenue is profitable after you account for network costs, customer acquisition, or the cost per bit to deliver their traffic.

Definition: What “Per User” Really Means

In telecom, “per user” typically means per subscriber or per account, not per device or per SIM card. An “active subscriber” is someone who has a live, revenue-generating service during the measurement period—whether that’s a mobile plan, a fiber broadband connection, or a bundled service package.

How is it calculated? You start by dividing total revenue by the number of units, users, or subscribers, and it’s particularly relevant for telecom and media industries that rely heavily on subscription models.

The key nuance? Subscriber counts fluctuate throughout any given month. You gain new customers, lose some to churn, and have seasonal variations. That’s why telecom operators calculate Average Revenue Per User using the average number of active subscribers across the period, not just a snapshot at month-end.

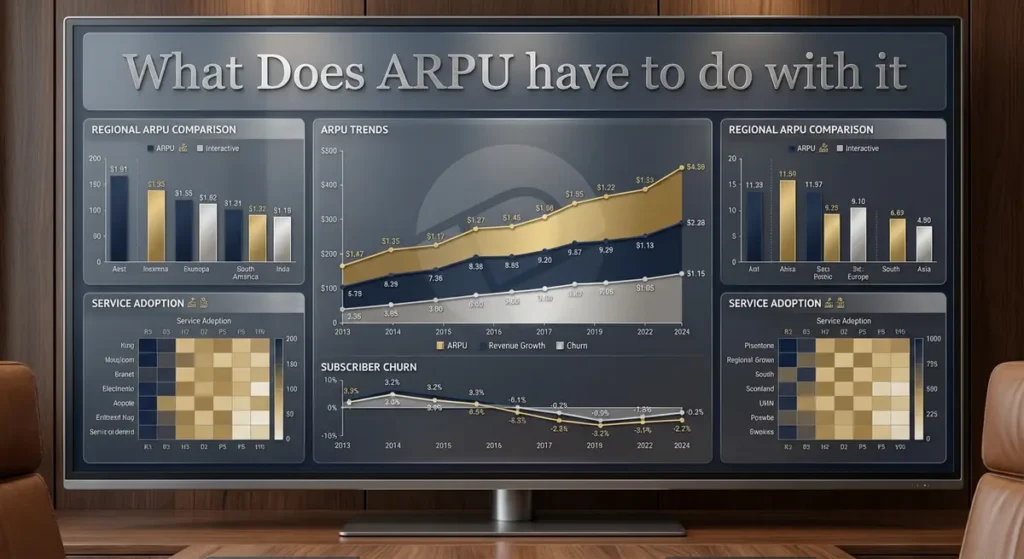

ARPU Formula and How to Calculate It

The formula is straightforward, but getting it right requires understanding what goes into each component.

The Formula

ARPU = Total Revenue ÷ Average Active Subscribers

Breaking Down the Formula

1. Total Revenue

This includes all service revenue from subscribers during the period: monthly recurring charges, usage fees, add-on services, equipment rentals, and value-added services. It typically excludes one-time hardware sales, installation fees, and non-recurring charges (though practices vary by operator).

2. Average Active Subscribers

This is the average number of paying subscribers across the measurement period. Most operators calculate this as: (Beginning Subscribers + Ending Subscribers) ÷ 2. More sophisticated operators use daily or weekly averages to account for mid-period fluctuations.

ARPU Calculation Examples

Example 1: Mobile Operator

A regional mobile carrier generated $12.5 million in service revenue in January. They started the month with 245,000 subscribers and ended with 255,000 subscribers.

Average subscribers: (245,000 + 255,000) ÷ 2 = 250,000

ARPU calculation: $12,500,000 ÷ 250,000 = $50.00 per month

Example 2: FTTH ISP

A fiber-to-the-home provider earned $890,000 in broadband service revenue in Q1 (3 months). Their average subscriber count across the quarter was 12,400 homes.

Quarterly ARPU: $890,000 ÷ 12,400 = $71.77 per subscriber per quarter

Monthly ARPU: $71.77 ÷ 3 = $72.59 per month

ARPU Calculator

Use our interactive calculator to compute your it instantly. Simply enter your total revenue and subscriber counts.

Compute ARPU in seconds with board-pack clarity

ARPU (Average Revenue Per User) = Total Service Revenue ÷ Average Active Subscribers. Enter revenue and subscriber counts to calculate instantly.

ARPU = Total Revenue ÷ Average Active Subscribers

Average Active Subscribers = (Beginning + Ending) ÷ 2

ARPU vs ARPPU vs ARPA vs ARPC

The telecom and SaaS worlds use several "average revenue per" metrics. Here's how they differ and when each matters.

| Metric | Denominator | Best Use Case | Typical Industry |

|---|---|---|---|

| ARPU | All active users/subscribers | Overall revenue health, pricing power | Telecom, ISPs, SaaS |

| ARPPU | Only paying users | Monetization effectiveness in freemium models | Gaming, apps, freemium SaaS |

| ARPA | Accounts (not individual users) | B2B services, family/household plans | Enterprise telecom, cable |

| ARPC | Customers (broader than users) | Retail, multi-product businesses | E-commerce, retail |

Why ARPPU Can Be Misleading in Telecom

In freemium app businesses, ARPPU (Average Revenue Per Paying User) makes sense because you have millions of free users and only a small percentage who pay. But in telecom? Nearly everyone is a paying subscriber. If you're connected to the network, you're paying something—even if it's a low-cost prepaid plan.

Why is it the standard in telecom? The distinction between "user" and "paying user" collapses when your business model is subscription-based from day one.

What Is a Good ARPU?

Here's the truth most benchmarking reports won't tell you: there is no universal "good" number. What matters is whether it supports sustainable margins after you account for network costs, customer acquisition costs (CAC), and churn.

The Trap

An operator with $80 ARPU and 15% churn might be in worse shape than one with $55 and 3% churn. If high it means nothing if you're bleeding customers or if your cost to serve is eating all the margin.

ARPU Context: What Really Matters

- Relative to cost per bit: If your network costs are rising faster than it, your margins shrink

- Relative to CAC: You need to recover customer acquisition costs within a reasonable payback period

- Relative to churn: High will cause high churn means you're constantly replacing revenue

- Trend over time: Is it growing, flat, or declining? Direction matters more than absolute value

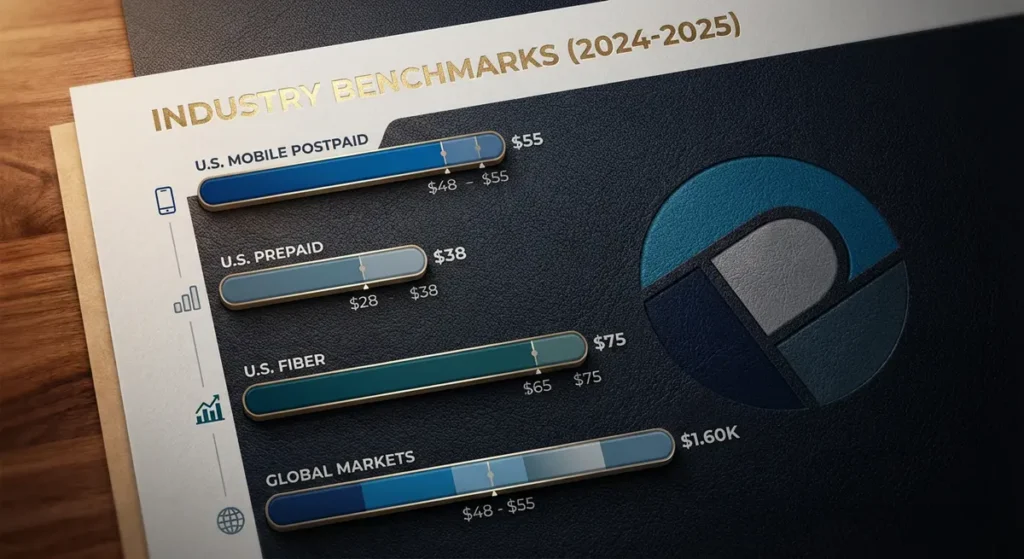

Industry Benchmarks (2024-2025)

While every market is different, here are some reference points from recent industry data:

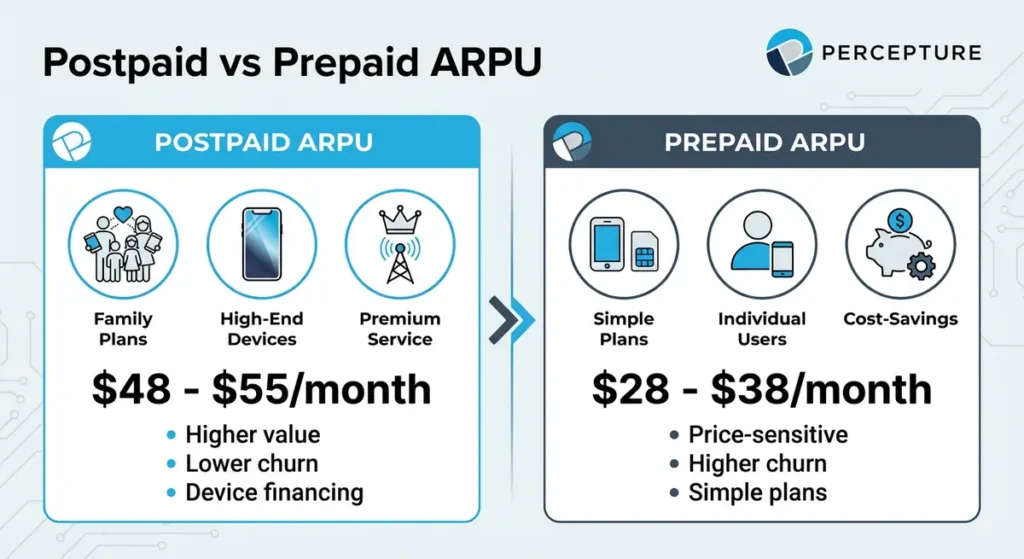

- U.S. Mobile (Postpaid): $48-$55/month (Verizon, AT&T, T-Mobile range)

- U.S. Mobile (Prepaid): $28-$38/month

- U.S. Fiber Broadband (Consumer): $65-$75/month

- U.S. Cable Broadband: $55-$70/month

- Global Mobile (Developed Markets): $25-$60/month

- Global Mobile (Emerging Markets): $3-$15/month

According to PwC's 2024-2028 Global Telecom Outlook, mobile ARPU is expected to decline at a compound annual growth rate (CAGR) of -1.3% over the next five years, while fixed broadband remains essentially flat. This makes operational efficiency and cost management even more critical for maintaining margins.

Sources: PwC Global Telecom Outlook 2024-2028, operator earnings reports, Statista

The Telecom Economics Angle Most Pages Miss

Here's where the conversation gets interesting—and where most of explainers stop short. It is a retail metric, but the real operator game is about the relationship between it, cost per bit, and margin per user.

Industry Expert Perspective

Hunter Newby is an entrepreneur, investor, and owner of Newby Ventures. As Co-Founder and Chief Strategy Officer of Telx, he pioneered the carrier-neutral Meet-Me-Room and the development of carrier hotels and data centers across the U.S. Hunter is a recognized authority in network-neutral interconnection and has been instrumental in advancing Internet Exchange Point (IXP) infrastructure to improve connectivity and reduce costs for telecom operators.

"Cities with neutral interconnection facilities benefit from low-latency connections, access to inexpensive, wholesale IP transit, and proximity to cloud services and content delivery networks. Any area with an IXP can keep pace with the quickly evolving Internet."

— Hunter Newby, Owner, Newby Ventures

InterGlobix Magazine, "Closing The Digital Divide Through Internet Exchange Points"

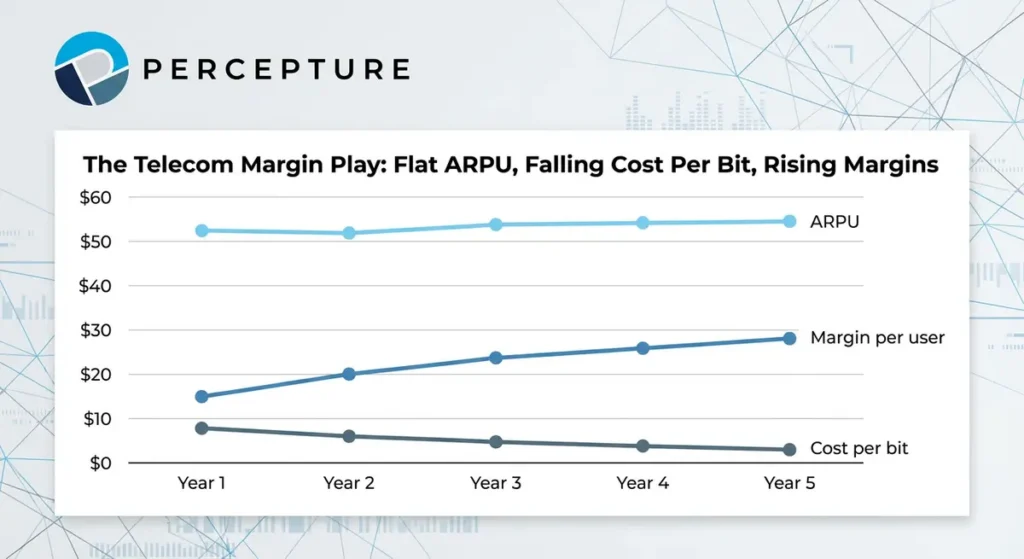

When ARPU Is Flat, Operators Lower Cost Per Bit

In mature telecom markets, its growth has stalled or even declined. Customers won't pay significantly more for the same service, and competition keeps pricing pressure high. So how do operators maintain or grow margins?

They focus on reducing the cost per bit—the expense of delivering each unit of data traffic. This is where network architecture, interconnection strategy, and peering become critical.

The Margin Equation

Margin per User = ARPU - (Cost per Bit × Usage) - Fixed Costs per User

When it is flat, the only levers you can pull are:

- Reduce cost per bit (network efficiency, peering, edge caching)

- Lower fixed costs per user (automation, operational efficiency)

- Increase usage without proportional cost increases (upsell, bundles)

From Retail Metrics to Capital Markets

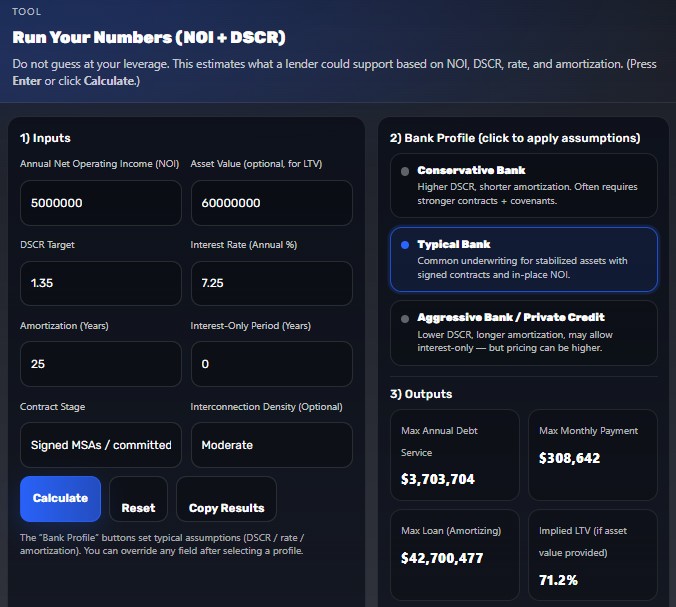

While ARPU is a vital retail KPI, its true power lies in its impact on infrastructure valuation. For operators and developers, a stable or growing ARPU is the primary engine for securing favorable Data Center Financing Structures.

Financial institutions view ARPU as the "predictable yield" that justifies heavy CAPEX investments. If you are modeling the feasibility of a new build or an edge expansion, understanding this revenue-to-capital relationship is critical. Click on the image link below to access our Data Center Financing Calculator.

[Interactive Tool: Calculate your Data Center Financing Structures here or click image above]

The Interconnection Strategy: Pushing Traffic to the Edge

One of the most effective ways to reduce cost per bit is to push interconnection closer to the edge—establishing local Internet Exchange Points (IXPs) and peering relationships that reduce expensive backhaul costs.

When an ISP in a rural market has to backhaul all traffic hundreds of miles to a major metro for interconnection, they're paying transit costs on every bit. But if they can peer locally at a regional IXP, they:

- Reduce latency for end users

- Lower transit and backhaul costs

- Improve service quality without raising it

- Increase margin per user by cutting network costs

This is the strategic insight that separates sophisticated operators from those who only watch ARPU. It tells you what's coming in the door. Cost per bit tells you what you're keeping.

We help telecom teams turn metrics into operating systems

Reporting packs, agent workflows, and growth loops built for infrastructure operators

How to Increase ARPU in Telecom (Without Gimmicks)

It's about delivering more value and capturing a fair share of that value through smart pricing, packaging, and retention strategies.

1. Mix Shift: Premium Plans and Bundles

The fastest way to increase it is to shift your customer mix toward higher-value plans. This doesn't mean raising prices across the board—it means making premium tiers more attractive.

Proven Mix-Shift Tactics:

- Bundled services: Mobile + broadband + TV packages increase it and reduce churn

- Managed Wi-Fi and security: Value-added services that cost little to deliver but command $5-15/month premiums

- Business-grade SLAs: For SMB customers, guaranteed uptime and priority support justify 30-50% higher calculation

- Device financing: Spreads device costs into monthly payments, increasing reported it (though margin impact varies)

2. Pricing Discipline: Renewal Timing and Discount Control

Many operators inadvertently suppress it through aggressive promotional pricing and poor discount discipline. Every "first 6 months free" or "50% off for life" promotion erodes long-term.

Quick Win: Renewal Optimization

Analyze your customer base by cohort. Customers who signed up during heavy promotional periods often have 20-40% below standard rates. At renewal, migrate them to current pricing with a "loyalty upgrade" that adds value (more speed, better support) to justify the increase.

3. Retention: Often "Rises" When You Stop Bleeding High-Value Subs

Here's a counterintuitive insight: sometimes ARPU increases not because you're earning more per customer, but because you're losing fewer high-value customers.

If your churn is concentrated among premium subscribers (who often have more options and higher expectations), your average will drift downward even if you're not changing pricing. Retention programs that target high-value segments can stabilize or increase ARPU without any pricing changes.

4. Protect it by Reducing Cost Per Bit

This circles back to the economics discussion: you don't always need to increase it to improve profitability. If you can reduce your cost to serve through better peering, edge caching, or network optimization, you achieve the same margin improvement without the customer friction of a price increase.

Strategic Approach

The most sophisticated operators pursue a dual strategy: modest ARPU growth through mix shift and value-added services, combined with aggressive cost-per-bit reduction through network efficiency. This creates a margin expansion that's sustainable and doesn't rely on pricing power alone.

(VIDEO: "5 Ways to Increase ARPU Without Raising Prices")

ARPU for FTTH and ISPs

For fiber-to-the-home (FTTH) providers and independent ISPs, ARPU takes on special significance because your build economics depend on it.

Why it Matters in FTTH Build Economics

When you're building fiber infrastructure, your business case is built on assumptions about:

- Take rate: What percentage of homes passed will become subscribers?

- Average Revenue Per User: How much will each subscriber pay per month?

- Churn: How long will they stay?

A 10% miss on its assumptions can turn a profitable build into a marginal one. That's why FTTH operators obsess over attach rates for value-added services.

Common FTTH ARPU Levers

- Speed tiers: 100 Mbps, 500 Mbps, 1 Gbps, multi-gig—each tier commands a premium

- Managed Wi-Fi: Whole-home mesh systems add $10-15/month with minimal cost

- Security and parental controls: Software-based add-ons with high margins

- Static IP and business services: SMB customers pay 50-100% premiums for business-grade service

- Voice services: VoIP bundles add $15-25/month

According to recent industry data, U.S. fiber broadband consumer ranges from $65-$75/month, with business and wholesale fiber can reach $95-$100/month. Operators like Frontier and AT&T have reported fiber in the $65-$73 range as of 2024-2025.

ARPU for Mobile Operators

Mobile ARPU is one of the most closely watched metrics in telecom investor relations. It's reported quarterly by every major carrier and dissected by analysts looking for signs of pricing power and competitive positioning.

Postpaid vs Prepaid ARPU

Mobile operators typically report it separately for postpaid and prepaid segments because they behave very differently:

Postpaid ARPU

Typical range: $48-$55/month (U.S. major carriers)

Characteristics: Higher value, lower churn, includes device financing, family plans, and premium add-ons

Prepaid ARPU

Typical range: $28-$38/month (U.S. major carriers)

Characteristics: Lower value, higher churn, price-sensitive customers, simpler plans

What Drives Mobile ARPU

- Plan mix: Unlimited vs metered, family vs individual

- Device financing: Monthly device payments increase

- Add-on services: International roaming, premium data, device protection

- 5G premium tiers: Some carriers charge premiums for 5G access or ultra-wideband service

According to Investopedia, mobile can include interconnection-related revenue dynamics in some contexts, particularly where regulatory interconnection systems generate incoming call revenue for operators.

Common ARPU Mistakes

Even experienced operators make these ARPU calculations and interpretation errors. Here's what to watch for.

❌ Mistake #1: Wrong Denominator

The error: Using total users instead of paying users, or using end-of-period subscriber count instead of average.

The fix: Always use average active subscribers across the period: (Beginning + Ending) ÷ 2, or better yet, a daily average if you have the data.

❌ Mistake #2: Ignoring Revenue Recognition Timing

The error: Including one-time charges, installation fees, or hardware sales in Average Revenue Per User calculations.

The fix: It should reflect recurring service revenue only. One-time charges distort the metric and make period-over-period comparisons meaningless.

❌ Mistake #3: Not Separating Consumer vs Business ARPU

The error: Blending consumer and business subscribers into a single figure.

The fix: Business customers typically have 50-100% higher Average Revenue Per Userthan consumer customers. Track them separately to understand segment performance and avoid misleading trends.

❌ Mistake #4: Chasing it Without Watching Churn

The error: Implementing aggressive price increases that boost it but trigger customer defections.

The fix: Always monitor it alongside churn rate and customer lifetime value (CLV). A 10% increase that causes 5% additional churn might destroy value, not create it.

Frequently Asked Questions

What does ARPU stand for?

ARPU stands for Average Revenue Per User. It measures the average revenue a company earns from each subscriber or customer over a specific period, typically monthly.

How do you calculate ARPU?

Average Revenue Per User is calculated by dividing total service revenue by the average number of active subscribers during the period. Formula: ARPU = Total Revenue ÷ Average Active Subscribers. Use the average of beginning and ending subscriber counts, not just the end-of-period number.

What is a good ARPU for telecom?

It depends on your market, service type, and cost structure. U.S. mobile postpaid Average Revenue Per Usertypically ranges from $48-$55/month, while fiber broadband ARPU ranges from $65-$75/month.

What's the difference between ARPU and ARPPU?

Average Revenue Per User includes all active users in the denominator, while ARPPU (Average Revenue Per Paying User) only includes users who made a payment. ARPPU is more relevant for freemium business models. In telecom, where nearly all users are paying subscribers, ARPU is the standard metric.

How can telecom operators increase ARPU?

Operators can increase ARPU through: (1) mix shift to premium plans and bundles, (2) value-added services like managed Wi-Fi and security, (3) pricing discipline at renewal, (4) reducing churn among high-value customers, and (5) upselling business-grade services to SMB customers. The most sustainable approach combines modest ARPU growth with cost-per-bit reduction.

Why is ARPU declining in many telecom markets?

ARPU is declining in mature markets due to intense competition, regulatory pressure, and the commoditization of basic connectivity services. According to PwC's Global Telecom Outlook, mobile ARPU is expected to decline at a -1.3% CAGR through 2028. This makes operational efficiency and cost management critical for maintaining profitability.

Should ARPU include device financing?

Practices vary. Some operators include device financing in reported ARPU because it's part of the monthly bill, while others separate it to show "service ARPU" vs "equipment ARPU." For internal analysis, it's best to track both separately so you can see true service revenue trends independent of device sales cycles.

How does ARPU relate to customer lifetime value (CLV)?

ARPU is a component of CLV. Customer lifetime value is calculated as: CLV = (ARPU × Average Customer Lifespan) - Customer Acquisition Cost - Cost to Serve. Higher ARPU increases CLV, but only if it doesn't trigger higher churn or require proportionally higher costs to maintain.

What's the relationship between ARPU and cost per bit?

ARPU is a retail metric (revenue per subscriber), while cost per bit is a network efficiency metric (cost to deliver each unit of data). The margin per user is determined by the gap between ARPU and the total cost to serve, which includes cost per bit multiplied by usage. When ARPU is flat, operators improve margins by reducing cost per bit through better network architecture and interconnection strategies.

How often should ARPU be calculated and reported?

Most telecom operators calculate ARPU monthly for internal management and report it quarterly to investors. Monthly tracking allows you to spot trends quickly, while quarterly reporting smooths out seasonal variations and one-time events. For strategic planning, look at 12-month rolling averages to see true directional trends.

Can ARPU be too high?

Yes. If your ARPU is significantly above market rates, you may be vulnerable to competitive pressure and customer churn. High ARPU can also indicate you're under-investing in customer acquisition (serving only premium customers) or that you're extracting maximum value from a declining customer base. Sustainable ARPU growth should align with value delivery and market positioning.

How do Internet Exchange Points (IXPs) affect ARPU?

IXPs don't directly affect ARPU (which is a revenue metric), but they significantly impact the profitability of that ARPU. By enabling local peering and reducing backhaul costs, IXPs lower the cost per bit to deliver service. This means operators can maintain competitive ARPU while improving margins, or they can pass savings to customers to defend market share without sacrificing profitability.

Scale Your Telecom Infrastructure

Optimizing ARPU is only half the battle; the other half is operationalizing that growth. Explore our executive resources for infrastructure leaders:

- Growth: Partner with a Telecom Marketing & PR Agency to drive high-value "mix-shifts" and brand authority.

- Efficiency: Implement AI Agents for Telecom Operations to lower your cost-per-bit while maintaining premium service levels.

- Strategy: Join us at Metro Connect USA 2026 to discuss the future of interconnection and capital flow.

- Financials: Beyond ARPU, master your overhead with our Telecom Expense Management Guide.

Ready to Turn ARPU Insights Into Action?

Percepture helps telecom operators and infrastructure teams build executive-grade AI Agents that streamline reporting packs, AI-powered workflows, and growth systems that turn metrics into operating leverage. Built for telecom operators, ISPs, and infrastructure teams by telecom industry legend, Hunter Newby & the Percepture team, led by Alex Mannine, a Co-Founder of Pyra AI Agents.