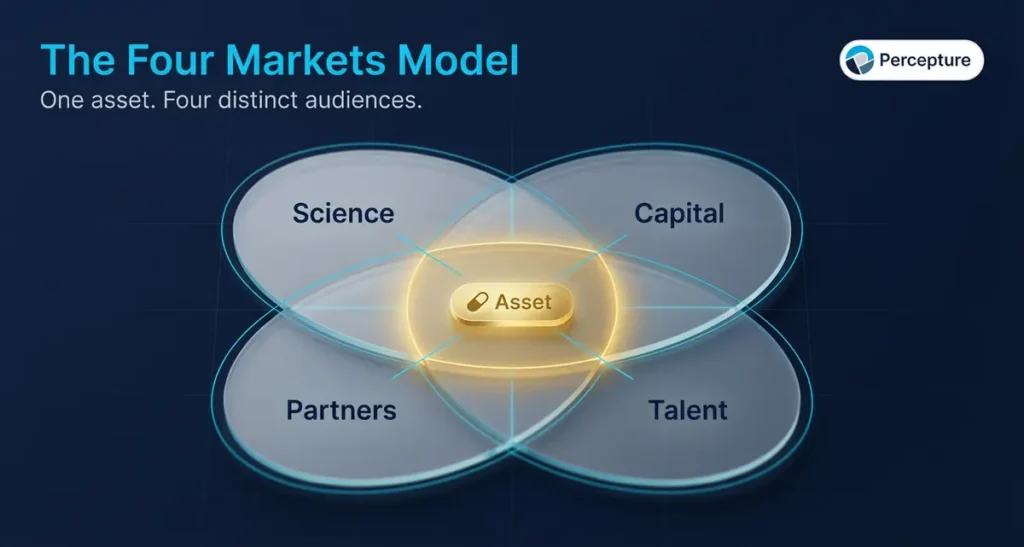

Biotech marketing is different because it speaks to four audiences at once: scientists who evaluate your data, investors who fund your runway, partners who license or co-develop, and talent who join your team. Unlike consumer brands that optimize for a single buyer journey, a life sciences marketing agency working in biotech must build trust across science, capital, collaboration, and recruitment at the same time.

Want a biotech marketing plan that investors and partners trust?

Talk with Percepture. We’ll review your Proof Packet, identify what to publish next, and map a 90-day signal plan.

Every press release, every LinkedIn post, every conference abstract becomes a signal that compounds or contradicts. The companies that grow fastest treat marketing as a proof system, not a megaphone. This article explains how biotech marketing works in 2026.

Quick Summary

- Biotech marketing must serve science reviewers, investors, partners, and talent simultaneously.

- The Four Markets Model explains why one message cannot work for all four groups.

- The Proof Packet defines the eight assets that build credibility across every channel.

- The Signal Loop shows how one update can trigger compounding trust when distributed correctly.

- SEO, AI search, LinkedIn, and investor updates are now the highest-ROI channels for early-stage biotech.

- Publishing cadence matters more than budget; consistency signals momentum and operational discipline.

What Is Biotech Marketing?

Biotech marketing is the strategic communication of scientific progress, clinical milestones, and partnership opportunities to multiple stakeholder groups. It combines regulatory compliance, investor relations, scientific credibility, and digital visibility to build trust and accelerate adoption across science, capital, partnership, and talent markets.

What Changed in Biotech

Three forces reshaped biotech marketing between 2020 and 2026.

First, clinical trial activity exploded. ClinicalTrials.gov now lists over 562,000 registered studies, with more than 66,000 actively recruiting. That volume creates noise. Investors, partners, and patients cannot track every trial. The companies that surface are the ones that publish updates, explain results, and connect dots across platforms.

Second, AI entered the workflow. Reuters reported in late 2024 that drugmakers are deploying agentic AI to speed regulatory submissions and clinical operations, with productivity gains expected to compound over the next few years. That means faster cycles, more data, and higher expectations for how quickly companies communicate progress.

Third, capital became more selective. McKinsey research shows that fewer than 10% of molecules that enter Phase I trials reach FDA approval, and the fully loaded cost per approved drug can exceed $2 billion when you include failures. Investors now demand proof of concept, proof of market, and proof of execution before they write checks. Marketing is how you show that proof between funding rounds.

The FDA continues to enforce truthful, balanced, and substantiated claims, and the agency monitors promotional spend closely. UCSF reported that university technology transfer offices are licensing more inventions than ever, which means more early-stage biotech companies competing for the same pool of attention, capital, and partnership deals.

1: The Four Markets Model

Most biotech companies think they have one audience. They do not.

Every piece of content you publish is evaluated by four separate markets, each with different priorities, different timelines, and different definitions of proof.

The Science Market includes peer reviewers, KOLs, clinicians, and academic collaborators. They care about data quality, reproducibility, and whether your work advances the field. They trust publications, posters, and preprints.

The Capital Market includes VCs, institutional investors, and analysts. They care about market size, competitive moat, regulatory path, and team execution. They trust pitch decks, investor updates, and third-party validation like grants or partnerships.

The Partner Market includes pharma BD teams, CROs, CDMOs, and co-development prospects. They care about IP position, clinical traction, and whether you can deliver on timelines. They trust case studies, white papers, and direct outreach.

The Talent Market includes scientists, operators, and advisors. They care about mission, culture, funding runway, and career growth. They trust LinkedIn, Glassdoor, and referrals.

A single press release about a Phase I readout will be read four different ways. The scientist will look for endpoints and statistical significance. The investor will look for patient enrollment speed and cash burn. The partner will look for manufacturing complexity. The recruiter will look for team stability.

Biotech content marketing must account for all four reads at once.

The Four Markets at a Glance

| Market | What They Care About | Proof They Require |

|---|---|---|

| Science | Data quality, reproducibility, novelty | Publications, posters, preprints, KOL quotes |

| Capital | Market size, moat, regulatory path, execution | Pitch decks, investor updates, grants, deals |

| Partners | IP position, clinical traction, delivery capacity | Case studies, white papers, partnership history |

| Talent | Mission, culture, funding runway, growth | LinkedIn presence, Glassdoor, team bios |

2: The Proof Packet

Biotech companies do not fail because they lack science. They fail because they cannot prove the science fast enough to the right people.

The Proof Packet is the collection of assets you build to demonstrate progress across all four markets. It is not a pitch deck or a website. It is the full library of credibility signals that let each audience verify your claims independently.

Here are the eight core assets every biotech company should build:

- Mechanism of Action Explainer – A 500-word page or 90-second video that explains what your molecule does, why it works, and what problem it solves. This is for partners and talent who need to understand your science without reading a 40-page deck.

- Clinical Milestone Timeline – A visual roadmap showing past milestones, current trials, and projected regulatory events. This is for investors and partners who need to see momentum and de-risk timelines.

- Publication and Poster Archive – A dedicated page linking to every peer-reviewed paper, conference abstract, and preprint. This is for the science market and for life science SEO that drives organic discovery.

- Investor Update Series – Quarterly or bi-annual updates that summarize progress, spending, and next steps. This is for current and prospective investors who need transparency between funding rounds.

- Partnership Case Study – A one-page story about a successful collaboration, licensing deal, or co-development project. This is for BD teams evaluating whether you can execute.

- Team Bios with Credentials – LinkedIn-style profiles for founders, advisors, and key hires that show domain expertise and past exits. This is for talent and investors who bet on people, not just science.

- FAQ Page for Regulatory and Safety – A compliance-friendly page that answers common questions about safety, efficacy, and regulatory status. This is for patients, clinicians, and partners who need reassurance.

- Media and Press Page – A running list of press mentions, podcast appearances, and third-party coverage. This is for everyone; it signals external validation and momentum.

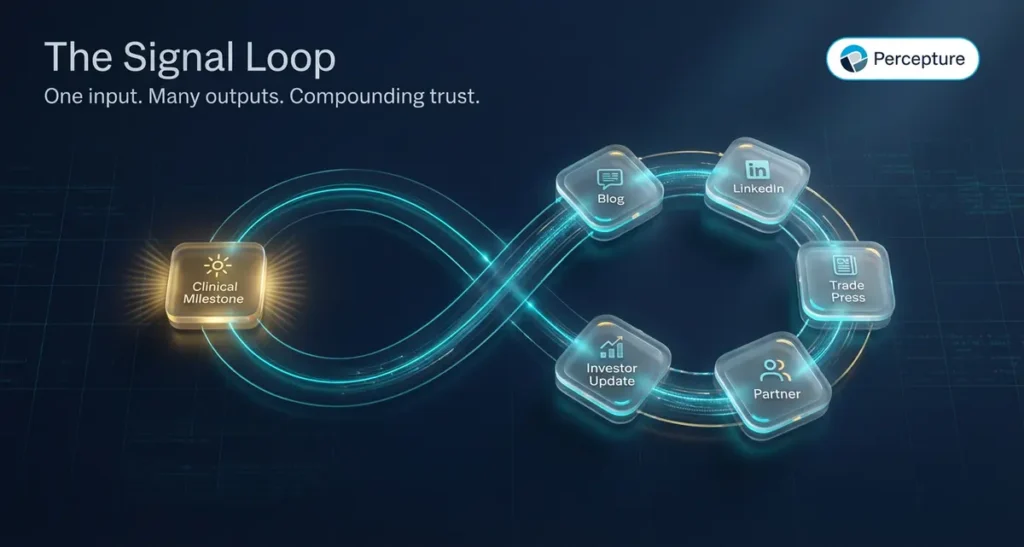

3: The Signal Loop

One update can trigger dozens of touchpoints if you structure it correctly.

The Signal Loop is the process of turning a single piece of news into a multi-channel cascade that reaches all four markets and reinforces itself over time.

Here is how it works:

You publish a clinical milestone. That milestone becomes a blog post on your website, optimized for life science content marketing and AI search. The blog post gets shared on LinkedIn with a founder quote. The LinkedIn post gets picked up by a trade publication. The trade mention gets added to your press page. The press page gets linked in your next investor update. The investor update gets forwarded to a potential partner. The partner visits your site, reads the blog, downloads a white paper, and requests a meeting.

That is the Signal Loop. One input, many outputs, compounding trust.

The loop only works if you have the infrastructure in place: a blog that ranks, a LinkedIn presence that engages, a press page that updates, and an email list that converts.

Biotech digital marketing is not about running ads. It is about building loops that turn momentum into visibility, and visibility into action.

“One clinical update can generate a dozen touchpoints if you structure the Signal Loop correctly. Most biotech companies publish once and move on. The winners republish, reframe, and reinforce.”

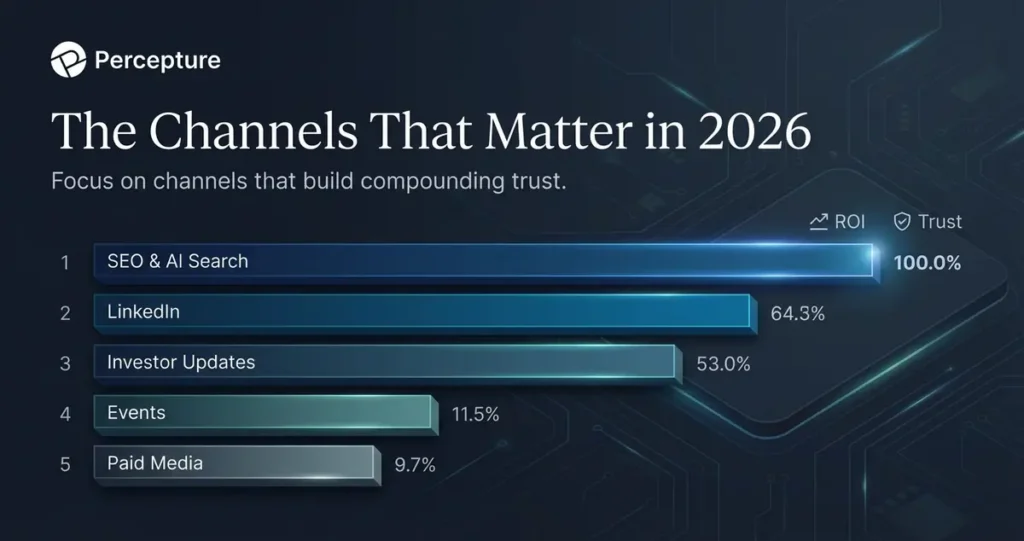

The Channels That Matter in 2026

Biotech companies do not need every channel. They need the channels that reach decision-makers and build compounding trust.

SEO and AI Search

Your website is the only asset you fully control. When investors Google your company name, when partners search for your indication, when scientists look for your publications, your site must rank and answer.

Digital marketing for life sciences now includes optimizing for AI search engines like Perplexity, ChatGPT, and Google’s AI Overviews. That means structured data, clear definitions, and citable facts.

LinkedIn is where biotech gets discovered. Founders, scientists, and BD teams are all active. A single post from a credible founder can reach thousands of investors, partners, and recruits. Consistency matters more than virality.

Paid Media

Paid ads work for top-of-funnel awareness and event promotion, but they do not replace trust. Use LinkedIn Ads and Google Ads to amplify content that already converts organically. Do not use paid media to replace a weak Proof Packet.

Events and Conferences

CPHI, BIO, ASCO, ASH, and JPM are where some deals happen. But the deal starts before the meeting. Your booth, your poster, and your pre-conference outreach all depend on whether your digital presence already established credibility.

Press and Media

Earned media in trade publications like FierceBiotech, Endpoints News, and STAT signals momentum. But you cannot earn coverage without a story. The story comes from your Proof Packet and your Signal Loop.

Investor Updates

Email is still the highest-converting channel for investor relations. A quarterly update that summarizes progress, spending, and next milestones keeps your cap table engaged and makes the next fundraise easier.

What to Publish First

Most biotech companies freeze because they do not know where to start. They have limited budget, limited time, and no marketing team.

Start with the assets that unlock the most doors.

| Stage | Primary Goal | What to Publish First |

|---|---|---|

| Pre-seed / Seed | Prove the science and attract early capital | Mechanism explainer, founder bios, LinkedIn presence, 1 peer-reviewed publication or preprint |

| Series A | Show clinical traction and recruit talent | Clinical milestone timeline, investor updates, team page, FAQ page, press mentions |

| Series B | Attract partners and prepare for BD | Partnership case study, white papers, conference posters, media coverage archive |

| Series C / Pre-commercial | Build market awareness and adoption | Full Proof Packet, SEO-optimized blog, AI-ready content, paid media campaigns |

Ready to Build a Biotech Marketing Strategy That Moves All Four Markets?

We help biotech companies turn clinical milestones into trust, visibility, and action. From SEO and AI search to investor updates and partnership content, we build the Proof Packet and Signal Loop that accelerate your next funding round.

Want a biotech marketing plan that investors and partners trust?

Talk with Percepture. We’ll review your Proof Packet, identify what to publish next, and map a 90-day signal plan.

Frequently Asked Questions

1. What is biotech marketing?

Biotech marketing is the strategic communication of scientific progress, clinical milestones, and partnership opportunities to investors, partners, scientists, and talent. It combines regulatory compliance, digital visibility, and credibility-building to accelerate adoption and funding.

2. How is biotech marketing different from pharma marketing?

Pharma marketing targets patients and prescribers after approval. Biotech marketing targets investors, partners, and scientists before approval. The goal is not to sell a product; it is to prove the science, attract capital, and build partnerships.

3. What is the Four Markets Model?

The Four Markets Model explains that biotech companies must communicate to four audiences at once: the science market (peers and KOLs), the capital market (investors), the partner market (BD teams), and the talent market (recruits and advisors). Each group evaluates the same content differently.

4. What is the Proof Packet?

The Proof Packet is the collection of eight core assets that build credibility across all stakeholder groups: mechanism explainer, clinical timeline, publication archive, investor updates, partnership case studies, team bios, FAQ page, and press page.

5. What is the Signal Loop?

The Signal Loop is the process of turning one clinical milestone into a multi-channel cascade that reaches all four markets. One update becomes a blog post, LinkedIn share, press mention, investor email, and partner inquiry.

6. What channels should biotech companies prioritize?

SEO and AI search, LinkedIn, investor email updates, and earned media are the highest-ROI channels. Paid media works for amplification but cannot replace trust-building content.

7. How often should biotech companies publish content?

Publish every time you hit a milestone: clinical readout, partnership announcement, grant award, new hire, or publication. Between milestones, publish quarterly investor updates and monthly LinkedIn posts to maintain visibility.

8. Do biotech companies need a blog?

Yes. A blog is the foundation of SEO, AI search visibility, and long-term organic discovery. It is also the easiest way to explain complex science in plain language for non-technical stakeholders.

9. How do you optimize biotech content for AI search?

Use structured data, write clear definitions, include citable facts, and answer questions directly. AI search engines prioritize content that is easy to parse, factual, and well-sourced.

10. What is the biggest mistake biotech companies make in marketing?

They wait until they need funding to start marketing. By then, they have no SEO presence, no LinkedIn following, no press mentions, and no Proof Packet. Marketing must start at founding, not at Series A.

11. How much should a biotech company spend on marketing?

Early-stage companies should allocate 5% to 10% of budget to marketing, focused on content creation, SEO, and LinkedIn. Later-stage companies preparing for partnerships or commercialization should increase to 15% to 20%.

12. Can biotech companies do marketing in-house?

Yes, but it requires a founder or operator who understands both the science and the stakeholder landscape. Most companies benefit from working with a specialized agency that understands regulatory constraints, investor expectations, and scientific credibility.

Let’s Build Your Biotech Marketing Strategy

We work with pre-seed to Series B biotech companies to build the Proof Packet, launch the Signal Loop, and turn clinical progress into funding, partnerships, and talent.

What you get:

- SEO and AI search strategy

- Investor update templates

- LinkedIn content calendar

- Partnership case studies

- Full Proof Packet build-out