Marketing is not a brand project. It is a value creation lever that shows up in EBITDA, margin durability, and exit optionality. As a private equity marketing agency that has worked with PE-backed companies since 2004, we’ve seen what actually moves the needle: price realization, retention, CAC payback, channel de-risking, and exit narrative. These are not marketing metrics. They are P&L line items that determine hold period, exit multiple, and downside protection.

With over 31,000 portfolio companies valued at $3.7 trillion currently held longer than planned, PE firms need marketing that accelerates exits, not just “builds brand.” The question is no longer whether marketing matters. The question is: what are you actually paying for?

Want a PE-grade growth plan that shows up in pipeline and EBITDA?

Percepture builds measurable growth systems for firms and portfolio companies. We focus on in-market demand capture, buying-committee influence, and board-ready reporting. No fluff. Senior team. Clear execution.

- Faster payback: capture high-intent searches and convert them into qualified meetings

- Committee influence: keep decision makers engaged after conferences and sales touches

- Credibility stack: SEO + digital PR so buyers see a clean story before diligence

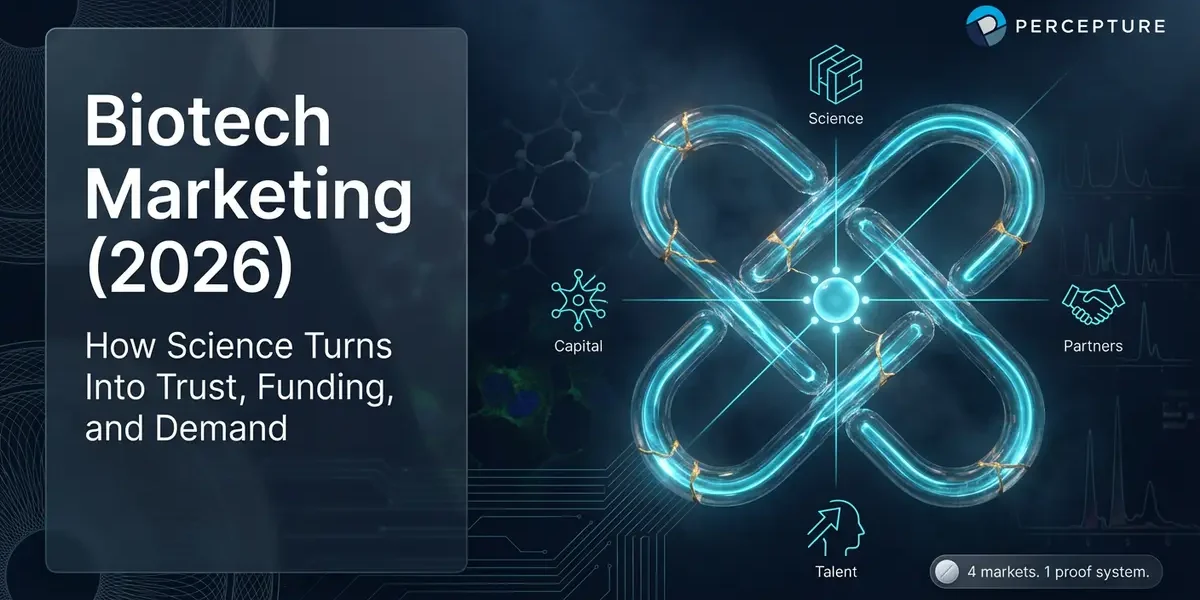

What “Private Equity Marketing Services” Really Means in 2026

Private equity marketing services in 2026 are specialized growth programs designed to improve EBITDA, reduce risk, and support exit multiples in PE-backed portfolio companies. They are not the same as traditional B2B marketing.

There are two distinct categories:

- Fund-level marketing: LP communications, fundraising materials, deal sourcing, and brand positioning for the fund itself.

- Portfolio company value creation: Revenue quality improvement, margin expansion, CAC efficiency, retention programs, and exit readiness for individual portfolio companies.

Most PE firms need both, but portfolio company value creation drives EBITDA. That’s where private equity marketing services deliver measurable ROI: reducing churn risk, improving realized price, lowering CAC payback, de-risking revenue channels, and building buyer-believable category leadership.

The focus is on outcomes that show up in board packs and IC memos, not vanity metrics like impressions or followers.

The 5 Things PE Actually Pays For

When PE firms invest in marketing for private equity, they are paying for specific EBITDA levers. Here are the five that matter most:

1. Price Realization (Margin Durability)

Outcome: Reduce discounting, improve realized price, and protect gross margin.

KPIs: Realized price vs. list, discount rate, win rate by segment, margin by product.

Typical Deliverables: Positioning refresh, packaging architecture, value propositions, sales enablement, proof assets.

Time to Signal: 30-90 days.

2. Revenue Quality & Retention (Downside Protection)

Outcome: Lower churn risk, improve Net Revenue Retention (NRR), and reduce customer concentration.

KPIs: NRR, GRR, logo churn, revenue churn, renewal rate, top 10 customer concentration.

Typical Deliverables: Onboarding sequences, adoption programs, renewal nurture, expansion plays, churn-bomb detector.

Time to Signal: 60-120 days.

3. Lower CAC & Faster Payback (Capital Efficiency)

Outcome: More growth per dollar, faster time-to-cash, and predictable pipeline.

KPIs: CAC, CAC payback, LTV:CAC, cost per qualified meeting, SQL-to-close rate.

Typical Deliverables: Paid search, LinkedIn ABM, programmatic retargeting, conversion optimization, attribution reporting.

Time to Signal: 14-60 days.

4. Channel De-Risking (Operational Resilience)

Outcome: Reduce dependency on one channel, partner, or rainmaker.

KPIs: % revenue by channel, pipeline by source, partner-sourced revenue.

Typical Deliverables: SEO/GEO authority building, partner ecosystem development, digital PR, lifecycle marketing.

Time to Signal: 90-180 days.

5. Exit Multiple Support (Narrative Credibility)

Outcome: Buyer-believable category leadership backed by proof.

KPIs: Share of search, earned media quality, win rate in competitive deals, sales cycle compression.

Typical Deliverables: Digital PR, thought leadership, benchmark reports, AI search visibility, diligence-ready proof assets.

Time to Signal: 120-180 days.

These five levers form the foundation of any effective private equity marketing strategy in 2026.

EBITDA Levers Marketing Can Move

| EBITDA Lever | What Marketing Changes | KPI | Time to Signal |

|---|---|---|---|

| Price | Reduces discounting, improves mix, strengthens value perception | Realized price, discount rate, ASP | 30-90 days |

| Volume | Increases qualified pipeline, raises conversion rate | Pipeline coverage, win rate, cycle time | 30-60 days |

| Retention | Lowers churn, raises renewals, expands accounts | NRR, GRR, churn rate | 60-120 days |

| Sales Efficiency | Shortens cycle time, improves rep productivity | CAC payback, cost per meeting, velocity | 30-90 days |

| SG&A Efficiency | Better targeting, less wasted spend, clearer attribution | Blended CAC, channel ROI | 60-90 days |

(These levers map directly to the P&L. CFOs care because they determine operating leverage, margin durability, and exit readiness. Marketing that moves these metrics is not a cost center. It is a value creation function.)

What the Board Pack Should Include

Board-level marketing reporting should focus on KPIs that tie directly to EBITDA and exit readiness. Here’s the checklist:

- Net Revenue Retention (NRR) / Gross Revenue Retention (GRR)

- CAC and CAC payback period

- Pipeline coverage (pipeline value / quota)

- Win rate and sales cycle length

- Realized price / discount rate

- Marketing-sourced pipeline %

- Churn rate (logo and revenue)

- Cost per qualified meeting

- Channel mix and concentration risk

This is the language of value creation. If your marketing partner can’t report on these metrics, they are not PE-grade.

Want a PE-grade plan tied to EBITDA and exit readiness?

We’ll map the lever, the 90-day plan, and the board-pack KPIs. Senior team. No fluff.

Standard vs Advanced PE Marketing Campaigns

Standard Campaign (6-10 weeks)

Goal: Prove one lever fast.

Scope: One ICP segment, one offer, one primary channel.

Deliverables: Landing pages, paid capture, basic attribution, weekly KPI pack.

Investment: $15k-$35k/month.

Best For: First 100 days post-acquisition, single-lever validation.

Advanced Campaign (90-180 days)

Goal: Install a repeatable growth operating system.

Scope: Full funnel, multi-channel, retention + expansion, board-grade reporting.

Deliverables: Pricing discipline, SEO/GEO authority, digital PR, lifecycle engine, churn prevention, exit narrative.

Investment: $35k-$75k+/month.

Best For: Platform builds, exit prep, multi-portfolio rollout.

Where AI Agents Fit in Private Equity Marketing

AI agents reduce what we call the “Associate Friction Index”—the manual, repetitive work that slows down PE teams and portfolio companies. They don’t replace strategy. They compress execution time and improve reporting accuracy.

Here’s where AI agents deliver time-back:

- Research: Competitive intelligence, SERP analysis, keyword discovery, market sizing.

- Outreach: Personalized email sequences, follow-up automation, meeting scheduling.

- Reporting: Board-pack generation, KPI dashboards, anomaly detection, variance analysis.

- Content Operations: Blog research, FAQ generation, compliance checks, SEO optimization.

- Diligence Support: Marketing audit automation, churn risk scoring, channel dependency analysis.

AI agents don’t replace senior operators. They free them up to focus on high-value decisions: pricing strategy, positioning, channel allocation, and retention playbooks.

“Networks go where networks are.”

— Hunter Newby, AI Interconnection Pioneer

In digital infrastructure and AI, Hunter Newby observed that networks cluster where interconnection already exists. The same principle applies to private equity: capital goes where credibility is proven, buyers go where the story is clean, and founders go where the value creation plan is believable. Marketing’s job is to build that gravitational pull.

How to Choose the Right Private Equity Marketing Partner

Not all marketing agencies understand PE value creation. Here are the questions you should ask:

- Thesis Alignment: “How do you align marketing to our specific investment thesis (buy-and-build, operational turnaround, etc.)?”

- Payback Modeling: “Can you model CAC payback and show sensitivity analysis?”

- Retention Impact: “How do you reduce churn risk in the first 180 days?”

- Pricing Discipline: “How do you help us improve realized price without breaking win rates?”

- Reporting Cadence: “What does your board-pack KPI reporting look like?”

- Compliance-Safe Marketing: “How do you handle regulated claims (life sciences, finance, etc.)?”

- Team Seniority: “Who actually does the work, and what’s their experience level?”

- Cycle-Tested: “Have you operated through multiple market cycles?”

- Exit Readiness: “How do you prepare companies for diligence and buyer scrutiny?”

- AI Defensibility: “How do you help us assess if our business model is AI-defensible?”

Private Equity Case Studies

CASE STUDY 1: ZenFi Networks

From Regional Challenger to Enterprise Pipeline and Exit Readiness

Client: ZenFi Networks (Digital Infrastructure, NYC Metro)

The PE Challenge

ZenFi is a digital infrastructure company with 1,100 route miles and network edge colocation sites across the NY–NJ region. They came to us with a clear PE-style goal: land enterprise deals, expand credibility fast, and create an exit-ready growth story.

NYC is crowded. Big incumbents dominate mindshare. ZenFi needed a way to win deals without wasting time on low-quality awareness spend. They also needed to influence specific decision makers in target accounts, including people they met at conferences.

What We Did

We built an integrated “capture + influence” engine that worked across the full buyer journey:

- High-intent demand capture using SEO and search ads to pull in buyers already looking for dark fiber and wireless infrastructure

- Account-level influence using paid social and programmatic retargeting to keep ZenFi in front of buying committees after meetings and events (NYC Government to win 8-Figure Job before Exit)

- Schema + rich snippet wins to position ZenFi as the default answer in their geography

- Conversion and funnel tuning so traffic turned into real conversations, not vanity clicks

Results (What a PE Team Cares About)

- 300% increase in qualified leads for dark fiber and connectivity

- 200% increase in inbound leads and 80% increase in web traffic

- #1 rich snippet for “Dark Fiber NYC” and visibility across 1,000+ focused terms

Exit Outcome: ZenFi was acquired by BAI Communications (and became part of Boldyn Networks).

Why This Matters in PE Terms

This is what “value creation marketing” looks like when it’s done correctly: capture demand, influence the committee, compress the sales cycle, and build a cleaner exit story.

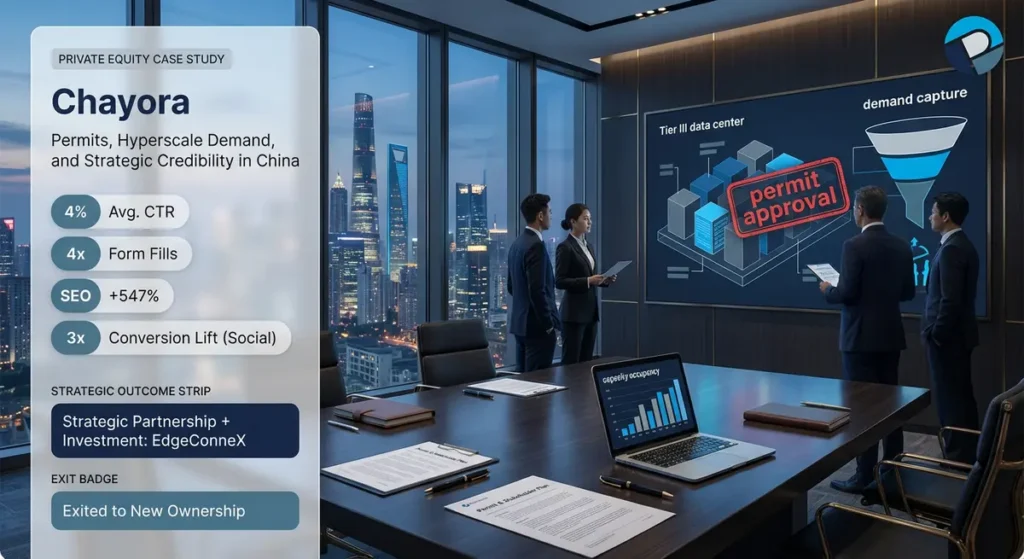

CASE STUDY 2: Chayora

Permits, Hyperscale Demand, and Strategic Credibility in China

Client: Chayora (Data Center Infrastructure, China)

The PE Challenge

Chayora needed to fill capacity in their Tier III data center, secure permits, win enterprise logos, and attract strategic capital.

In China, you do not “just run ads.” Regulatory approvals and stakeholder influence matter. After approvals, the business has to sell capacity fast.

What We Did

We ran an omni-channel program designed for credibility plus conversion:

- PR-led authority content to build trust with stakeholders

- SEO + paid search (including local engines) to capture high-intent demand

- Precision targeting across social, web, and app placements to keep decision makers engaged

- Conversion optimization to turn awareness into form fills and real pipeline activity

Results

- 4% average CTR (exceptional for a technical, high-quality audience)

- 4x increase in form fills (leads)

- Channel growth: SEO +547%, and 3x conversion lift from social targeting

Strategic Outcome: Chayora formed a strategic partnership with EdgeConneX, including a strategic investment publicly announced.

Why This Matters in PE Terms

When permits and credibility are a gating factor, marketing is not “promotion.” It becomes a risk-reduction tool that helps unlock capacity sales and improves strategic optionality.

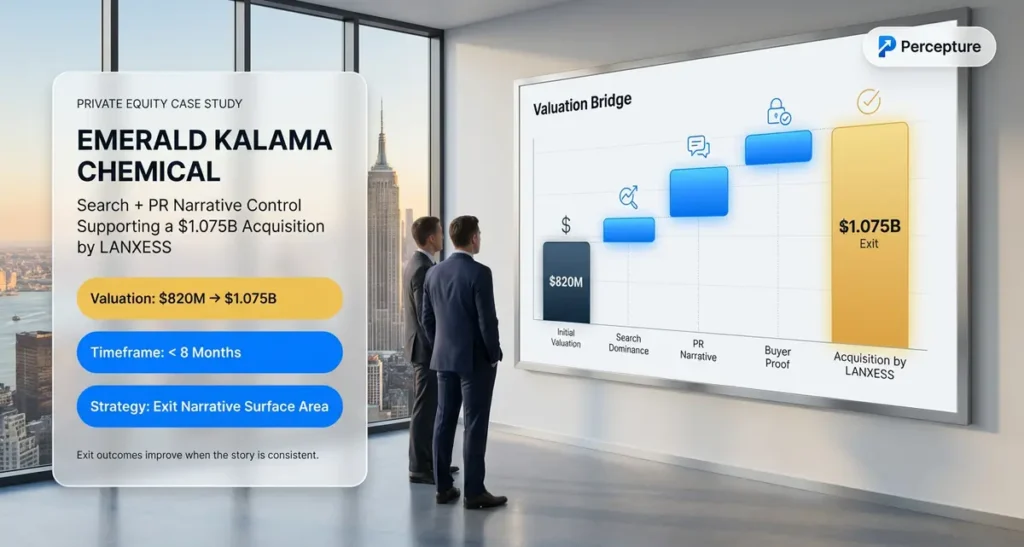

CASE STUDY 3: Emerald Kalama Chemical

Search + PR Narrative Control Supporting a $1.075B Acquisition by LANXESS

Client: Emerald Kalama Chemical (Specialty Chemicals)

The PE Challenge

They needed to increase visibility in the categories that mattered and make sure the market story matched the value story.

In a real transaction environment, buyers do diligence on the internet before the data room. If search results and PR coverage are messy, it creates friction.

What We Did

We treated search as an “exit narrative surface area,” not a traffic project:

- Built category dominance around the terms and products buyers research

- Strengthened authority signals with PR and digital PR

- Helped ensure press and narrative assets appeared where stakeholders look first

Result and Outcome

Valuation increased from $820M to over $1B in under 8 months.

Public transaction fact: LANXESS completed the acquisition at an enterprise value of USD 1.075B.

Why This Matters in PE Terms

Exit outcomes improve when the story is consistent across: search results, third-party credibility, and buyer-facing proof assets.

CASE STUDY 4: Top 5 Contract Manufacturer (Life Sciences)

Demand That Scaled to Capacity, Triggering Expansion and Hiring

Client: Top 5 Contract Manufacturer (Enterprise, Life Sciences)

The PE Challenge

A contract manufacturing division needed sustained demand growth tied to real commercial outcomes.

In life sciences and regulated environments, credibility is not optional. Buyers scrutinize claims, capabilities, and track record.

What We Did

We focused on the things that create compounding demand in high-trust markets:

- SEO and content that matched commercial intent

- Search capture to attract in-market buyers

- Conversion improvements so the right visits became real conversations

- Narrative support that made growth believable to stakeholders

Results and Outcome

Sales scaled from $250M to over $1B annually, maxing out capacity and contributing to operational expansion.

Public expansion reference: A €60M investment and ~70 new jobs were announced for the facility expansion.

Why This Matters in PE Terms

This is the clean kind of growth PE wants: demand that scales, a story that holds up, and operational expansion triggered by real sales pressure.

Why Percepture

Percepture has been operating since 2004. We’ve built growth systems through multiple market cycles, which reduces execution risk for PE-backed teams. Our delivery model is senior-only; every operator has 10+ years of experience, which compresses time-to-value and protects EBITDA from rework.

We have deep expertise in Telecom and Life Sciences—two sectors where buying committees are complex, sales cycles are long, and compliance is non-negotiable. That experience translates directly to PE value creation: we know how to build credibility in technical, regulated, high-trust environments.

We’re a full-stack growth partner: SEO, AI Search (GEO), digital PR, paid search, paid social, programmatic, CRO, and analytics. Our AI agents and AI Sales Agents reduce manual work and speed up reporting, outreach, and content operations for PE teams and portfolio companies.

The result: a diligence-grade growth engine with board-pack reporting tied to price realization, retention, CAC payback, and exit narrative. Not a collection of campaigns. A repeatable operating system.

Want a PE-grade plan tied to EBITDA and exit readiness?

We’ll map the lever, the 90-day plan, and the board-pack KPIs. Senior team. No fluff.

Frequently Asked Questions

What do private equity marketing services include?

Private equity marketing services include fund-level marketing (LP communications, fundraising, deal sourcing) and portfolio company value creation (revenue quality, margin expansion, CAC efficiency, retention programs, and exit narrative development). The focus in 2026 is on measurable EBITDA impact, not brand awareness.

These services are designed to improve P&L performance and support exit readiness. They are measured through board-pack KPIs, not vanity metrics.

How do PE firms measure marketing?

PE firms measure marketing through board-pack KPIs: CAC payback, Net Revenue Retention (NRR), churn rate, pipeline coverage, win rate, realized price, and sales cycle length. Marketing must tie directly to EBITDA levers and exit multiple support.

If marketing can’t be measured in these terms, it’s not PE-grade. The goal is to show up in the IC memo, not the brand deck.

How long does it take to see results?

Paid search and LinkedIn can show pipeline impact in 2-5 weeks. SEO and digital PR take 6-12 months to compound. Retention programs show signal in 60-120 days. The key is sequencing: prove fast levers first, then build durable assets.

PE firms should expect a mix of quick wins and long-term compounding. The best programs layer both.

Do PE firms care about SEO and AI search?

Yes. SEO and AI search (GEO) reduce long-term CAC, build category authority, and support exit multiples by making companies the “default choice” in their niche. Buyers pay more for companies that dominate search and get cited by AI.

SEO is not a vanity play. It’s a capital efficiency lever that compounds over time and reduces dependency on paid channels.

What is digital PR and why does it matter for PE?

Digital PR earns third-party validation in credible publications, which reduces sales friction, shortens cycle time, and supports pricing power. It also builds authority links that improve SEO and AI search visibility.

For PE-backed companies, digital PR is proof that the category leadership narrative is buyer-believable. It shows up in diligence and supports exit multiples.

What is the board-pack KPI set?

The board-pack KPI set includes: CAC, CAC payback, NRR, GRR, churn rate, pipeline coverage, win rate, sales cycle length, realized price, discount rate, and marketing-sourced pipeline percentage. These tie marketing directly to EBITDA and exit readiness.

This is the language Operating Partners and CFOs speak. If your marketing partner can’t report on these, they’re not PE-grade.

How do AI agents help private equity teams?

AI agents reduce Associate friction by automating research, outreach, reporting, and diligence tasks. They speed up board-pack generation, churn risk scoring, competitive intelligence, and content operations—giving PE teams “time back” for higher-value work.

AI agents don’t replace strategy. They compress execution time and improve accuracy.

What’s the difference between fund-level and portfolio company marketing?

Fund-level marketing focuses on LP communications, fundraising, and deal sourcing. Portfolio company marketing focuses on revenue growth, margin expansion, retention, and exit readiness. Most PE firms need both, but portfolio value creation drives EBITDA.

The skill sets are different. Fund-level marketing is institutional and compliance-heavy. Portfolio company marketing is growth-focused and KPI-driven.

How do you reduce churn risk in PE portfolio companies?

We install churn-bomb detectors: predictive models that flag at-risk accounts based on usage, support tickets, billing signals, and contract behavior. Then we deploy save playbooks tied to root cause, plus expansion plays triggered by value moments.

Churn prevention is downside protection. It improves NRR, reduces revenue volatility, and supports exit multiples.

What makes a marketing partner ‘PE-grade’?

PE-grade partners speak EBITDA, not impressions. They provide board-pack reporting, model CAC payback, understand hold periods, and deliver diligence-ready proof. They’ve operated through cycles, use senior-only teams, and install repeatable systems—not hero-dependent campaigns.

They understand that marketing is a value creation function, not a brand exercise.

Connect with us today!

COMPLIANCE NOTE:

If your marketing touches fund-level communications, be aware that the SEC’s Investment Adviser Marketing Rule (Rule 206(4)-1) requires net performance disclosure, fair and balanced presentation, and clear disclosure of compensated endorsements. We help PE firms navigate these requirements while building credible growth narratives.